What if a single state actually did secede?

Back when secession petitions were dominating the public eye after the 2012 election, I moved past the Civil War references and political disputes to take a look at what to me was a much more interesting question: if a U.S. state did legally secede from the Union, what would be the impact? My analysis looked at currency, trade, immigration, budgets, taxes and Internet domain names.

Practical consideration of secession

Originally published on Argus Leader Media’s Political Smokeout blog on Nov. 16, 2012.

Ever since some people decided that asking Barack Obama to let states secede would be a good idea, reactions have been varied. Some seem to take it quite seriously. Others view it as a “frustration release.” Some find the whole talk appalling, while others see it as a glorified joke.

Me? I find the whole thing endlessly fascinating.

What would happen if South Dakota actually seceded?

I don’t mean “tried to secede.” Obviously if South Dakota were determined to secede alone and the United States were determined to stop her, she would be stopped. And the thought of a second secession-sparked civil war involving multiple seceding states and modern weaponry is too terrible to dwell on.

But let’s say South Dakota voted to secede, and the United States said “good riddance” and approved it. Mutual consent from the seceding section and the rump state seems to be the only way such a thing legally happens. (This mutual consent does not necessarily have to be uncoerced, but never mind that for now.)

What does the new Republic of South Dakota (RSD) look like?

Well, in this scenario in which none of South Dakota’s neighbors secedes, the RSD would become an enclave inside the remaining United States of America.

This means RSD’s legal independence is not going to be pure. We would be dependent on our former countrymen not just to not invade us, but also for our economic wellbeing and comfort.

So let’s assume we’ve got a negotiated, amicable divorce here. Treaties are signed between the USA and the RSD. South Dakota enters into a military alliance with the United States. It forms, at least for the short term, a currency union. (The secessionist government might prefer to eventually print or mint its own currency, but let’s say they push that off into the future to minimize the considerable economic disruptions.)

More important than currency, at least in the short run, is the question of a customs union. Does South Dakota enter into one with the United States, allowing friction-free travel over South Dakota’s extensive land borders — good for residents, good for tourism, but weakening the new nation’s sovereignty and forfeiting potential revenue from tariffs and customs duties.

Let’s say the RSD Congress decides the economic benefits of free trade with the USA outweighs the other advantages, and enters into a customs union. Practically, then, some of the big day-to-day aspects of life are the same for the citizens of the world’s newest republic. They still shop with dollars and travel unimpeded over the border, they order packages from Amazon without having to pay customs. They can ship their agricultural produce over the border without having to pay tariffs.

In others words, the new RSD looks something like the member states of the current European Union.

What about the citizenship question? Who is a citizen of South Dakota and who is a citizen of the United States? Does every resident of South Dakota at the time of secession get an RSD passport? Only people who were born here or have lived here a certain length of time? Are people who weren’t born here subject to deportation?

I suspect that at least in the short term, the new South Dakota government will adopt a liberal attitude towards RSD citizenship, with a very low standard for acquiring it. Born here? Citizen. Living here? Citizen. Move to the new republican immediately after its founding? Citizen.

That’s because South Dakota, not very densely populated to begin with, is going to face an immediate emigration problem as people not high on the whole secession project flee. The new RSD government is going to want to A) put as few barriers as possible for people who want to stay, and B) probably encourage non-residents to move here, to counteract any population exodus with new taxpayers.

After the heady first years of Free South Dakota, citizenship may become more difficult to acquire, requiring a period of residency and other prerequisites instead of being handed out like candy. (The United States may insist on this if it faces a rush of Americans acquiring South Dakota citizenship for legal and tax reasons.) The question of dual citizenship with South Dakota and the USA would probably be negotiated by treaty as part of the secession.

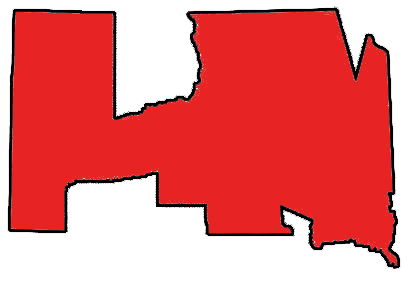

South Dakota, unlike many states in the USA, has large subsets of its land and population with different legal status — Native Americans. More than other subsets of the state, South Dakota’s reservations might decide they want no part with the new country, either remaining the USA or independently seceding. Either way, the new South Dakota might look less like a rectangle with a tail and more like this curious creature:

A map of South Dakota, with most of its reservations removed. Two interior reservations, Crow Creek and Lower Brule, were not excised.

That’s ignoring the question of the Lower Brule and Crow Creek, the two reservations squarely in the center of the state, and Flandreau, which to the best of my knowledge is very near to but not touching the Minnesota border.

The elephant in the room is the question of government spending and taxes, issues most discussion of the practicalities of secession seems to focus on.

South Dakota is a net recipient of federal funds, receiving more federal spending than residents pay in local taxes. So seceding would be a bad fiscal move for South Dakota — but maybe not by as much as you’d think.

If South Dakota secedes, its residents are immediately free from the burden of federal taxes. Hooray! But those residents also lose many benefits residents consider essential, which the new country would have to make up with new tax revenue.

Just looking at the basics, South Dakota’s most recent state budget included $1.2 billion in general fund revenue (from sources such as South Dakota’s sales tax) and $1.7 billion in federal funds, propping up programs such as K-12 education ($180 million — or another 1 percent added to the sales tax), higher education ($223 million), highways and transportation ($378 million) and taking care of people in need (around $750 million between the departments of Social Services and Human Services).

Just to replace those funds is going to require a 150 percent increase in South Dakota’s revenues.

If South Dakota is determined to remain an income-tax free land as an independent country, it could achieve this through consumption taxes. The sales tax would have to go from 4 percent to about 14 percent to accomplish this, or the RSD Congress could pass a more efficient Value Added Tax. But given that a huge percentage of South Dakota’s population lives within an hour or two of the state’s borders, high consumption taxes would encourage people to do their shopping just over the border. This is a smaller problem if you have customs posts on the border, but if you went for friction-free travel (as I supposed) you’re going to see a huge transfer of economic activity out of the new country and much less bang for the buck from the higher taxes — and thus a need for even more taxes.

So secession probably wouldn’t, in the end, spare South Dakotans the indignity of an income tax, though the RSD Congress could structure it how they wanted, perhaps going with a flat tax. A mixture of higher consumption taxes and a new income tax might meet these immediate revenue needs. There’s plenty of other sources — just to name one, the RSD could put up tolls on its highway system.

South Dakota gets more from the federal government than just the transfer payments reflected in its budget, however. Let’s look at a few big ones:

-

Spending on reservations. I don’t know how this breaks down, but if, as I surmised, many or all of South Dakota’s reservations would choose not to be a part of the new country, this federal spending would not become South Dakota’s responsibility. (It would probably save quite a bit of money on social services spending, as its reservations are disproportionately impoverished.)

-

Military spending. The Republic of South Dakota would probably remain some military force — its citizens are not a pacifistic lot — but overall it would probably be a freeloader of sorts with the United States, which completely surrounds it. The military is a big chunk of the US budget but would probably be relatively minor for the RSD.

-

Medicare. Unlike the prior two, there’s no getting out of this one. The Kaiser Family Foundation estimates that Medicare spending in South Dakota is about $1 billion per year, and the new state would be on the hook for just about all of it — the senior-heavy electorate would probably insist on a strong safety net. The actual figure could vary wildly depending on how the RSD structured its Medicare replacement — a clone of the existing single-payer model, or a more free-market version?

-

Farm subsidies. RSD’s ag-heavy voting bloc is probably going to insist on farm subsidies. The Environmental Working Group’s database says that in 2011, South Dakota received $725 million in farm subsidies, including subsidized crop insurance.

So even just taking Medicare and farm subsidies, you’ve got another $1.75 billion on top of $1.7 billion in state-budget federal spending to make up. Now we’re talking a 380 percent increase in South Dakota’s state tax burden, an extra $3.4 billion for a total of $4.6 billion from a state that used to just pay out just $1.2 billion from its own taxes. (Remember, however, as stated above, these new RSD taxes would replacing old US taxes.)

There’s probably other significant federal spending on South Dakota I’m not accounting for, but maybe not. South Dakota receives about 50 percent more federal spending than it pays in taxes, and since it pays $4.7 billion in federal taxes, you’re talking around $7 billion in total spending on and in South Dakota, or $2.35 billion more than South Dakotans pay. But between state taxes and “other” funds, South Dakota’s existing revenues generate about $2.2 billion, so the gap, in whatever direction it lies, is probably not big. (And this is presuming the new RSD government maintains spending at similar levels.)

An important consideration: 1 percent of the U.S. military budget is about $6.8 billion. Escaping South Dakota’s share of paying for the world’s biggest military is HUGE. (Our revenue, by comparison, is about 0.1 percent, or one one-thousandth, of the U.S. government revenue.)

The budget situation for an independent South Dakota would be daunting, but it wouldn’t necessarily be disastrous. Independence from the United States would bring plenty of new spending burdens, but it would also free South Dakotans from many of the obligations they are currently helping to support as a part of the US.

A few other final considerations. An independent South Dakota, surrounded by the United States, would be in a unique position to be a predatory country. The state of South Dakota liberalized its usury laws to attract credit card companies and banks from others states; the Republic of South Dakota could go full Switzerland and set itself up as an independent banking haven. Casinos situated on the country’s new border with the U.S. could attract considerable tourism.

Not losing South Dakota’s existing tourism would be a big concern. The new government would want to do its best to make the RSD an easy place for families to visit, while also adding new incentives for people to visit, as listed above.

The biggest risk for a seceded South Dakota, in my mind, is one I mentioned above — emigration, along with the related issue of capital flight. The new state would have to persuade citizens the new political venture was not a risk, that it was a safe place to live and work and keep their money — or attract new residents to replace those who left.

It would also be an opportunity for South Dakotans to remake their laws in a manner reflective of their desires, rather than reflecting compromises with other, culturally and socioeconomically different parts of the country. Citizens of a free South Dakota might be more willing to pay taxes if they felt more of a connection to where the money was being spent. History is full of countries willing to tax themselves far more than they were willing to let a foreigner tax them, and while the full United States isn’t (despite some ill-considered feelings on the part of some) a “foreign” country to South Dakota, taxing and spending WOULD be more local in a free South Dakota, and that means something.

All this, of course, presumes a best-case scenario, of a United States government that not only allowed South Dakota to secede but worked with it to create a treaty regime allowing for a relatively smooth transition, as well as presuming an enlightened RSD government making optimal decisions for the state. None of that would be givens in this already basically impossible scenario. This thought experiment developed the idea that secession wouldn’t necessarily be disastrous for South Dakota, but it very easily — maybe very probably — could be.

A few miscellaneous thoughts:

-

The South Dakota government bureaucracy would have to grow immensely, not only absorbing all the jobs done by federal bureaucrats in the state currently, but also many functions performed by officials in Washington, D.C.

-

Similarly, the legislative branch of the new country would no longer be a two-month part-time body. It would probably have to meet most of the year and pay its members a livable salary in order to meet the legislative demands of a new, free country.

-

As a free country, South Dakota would be entitled to its own top-level internet domain, like .fr or .de. Unfortunately, .sd is already taken by Sudan. So the Republic of South Dakota would have to go with something like .da, .ko, or .ta, all three of which appear to be available.

-

Water rights on the Missouri River would be a huge treaty nightmare.

-

Ellsworth Air Force Base would probably, but not necessarily, close. The Russian Federation, as successor state to the Soviet Union, maintains military bases in former Soviet republics, so there’s precedent for the US to keep Ellsworth open if it wanted to and both sides could agree. But most domestic military bases in the US are kept open in large part for political and economic development considerations, and a contracting US military would probably find a better use for its money than keeping open an enclave inside the RSD. If the base did close, this would be a serious hit to the economy of western South Dakota.

-

Right after passing a balanced budget amendment, South Dakota would become independent and have the right, if it wanted, to run a budget deficit and issue sovereign debt. Many economists view a deficit of around 3 percent of GDP to be a safe, sustainable level over the long term, and higher deficits acceptable in emergencies, so the RSD would have some flexibility during the transition crisis — if its lawmakers believed borrowing to be an acceptable alternative, which they might not. However, South Dakota would likely pay far more for its debt than the United States, given uncertainties about its future. The independent Texas Republic sought annexation to the United States in part because of major fiscal difficulties; a majority of its debt at the time of annexation was trading at just 25 cents on the dollar.

-

Would a seceding South Dakota have to absorb its share of the US national debt? This could be an important expense I didn’t account for above if it happened.

-

The rump United States of America would probably find South Dakota seceding to be at worst a minor annoyance. It would be just a drop in the bucket budget-wise.

-

Social scientists would find South Dakota, as an independent country surrounded by culturally identical neighbors but with a diverging set of laws, a fantastic natural experiment to compare the impact of culture vs. institutions.

-

Would abortion be illegal in the new country? The two statewide referendums in 2006 and 2008 suggest it might remain legal, if far more limited than currently. But it would be interesting to see how things shaped out once the question was up to the voters and legislators rather than constrained by court rulings.

-

The RSD’s political system could undergo some fascinating evolutions. Would the Democratic and Republican parties remain the dominant parties? Or would we see new parties emerge based on local issues. Perhaps one party focused on closer integration with the United States and another arguing for a more independent course. I predict a more competitive two-party system than the current Republican-dominated system would eventually emerge once politics became more local and less tied to national US debates, but the result wouldn’t necessarily be good news for liberal South Dakotans who are on the outs in the current system.

-

Post-secession, maybe Bernie Hunhoff would have better luck arguing for a more dynamic South Dakota flag.

Please point out any math mistakes, erroneous assumptions and overlooked variables in the comments. I know I have plenty of all of them.